Finding the right auto insurance can seem hard, but it’s not impossible. We’ll help you understand auto insurance better. You’ll learn about different coverage types, what affects your rates, and how to save on premiums.

It’s crucial to have the right insurance for your car, whether you’re new or experienced. We’ll cover liability, collision, and comprehensive coverage. This ensures you’re protected in accidents or unexpected events.

We’ll also talk about what affects your insurance rates. This includes your driving record and your car’s make and model. Knowing this can help you lower your premiums and find a auto insurance quote that fits your budget.

With our advice and tips, you’ll feel confident in choosing your auto insurance. You’ll be able to make smart choices and get the best coverage for your car.

Table of Contents

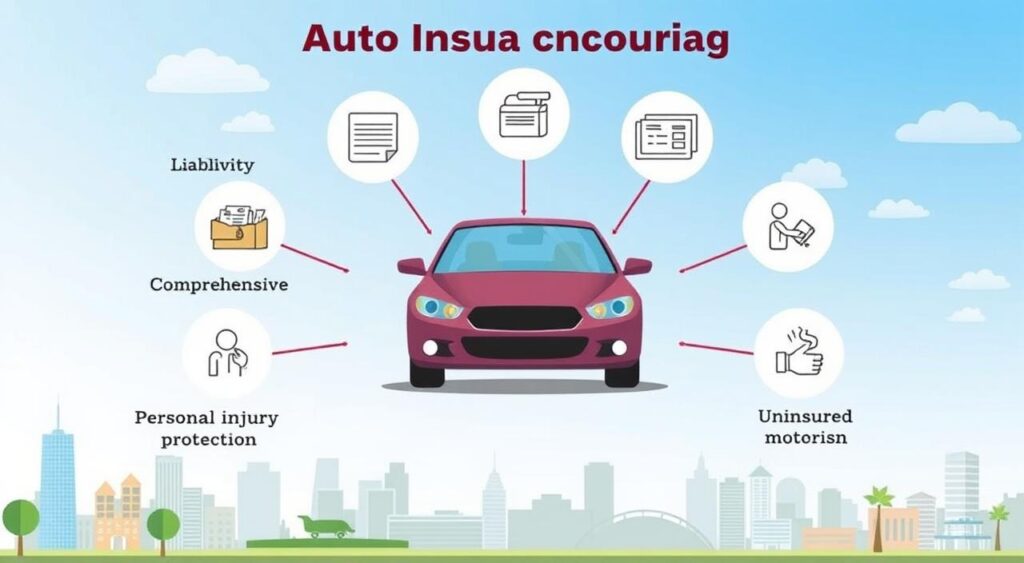

Understanding the Types of Auto Insurance Coverage

Auto insurance coverage is key to protecting your vehicle. There are two main types: liability coverage and collision and comprehensive coverage.

Liability Coverage

Liability coverage is the most basic and legally required. It covers damages you cause to others in an accident. This includes their medical bills, property damage, and legal fees. It’s vital to protect your finances in case of an accident.

Collision and Comprehensive Coverage

Collision and comprehensive coverage protect your vehicle. Collision covers damage from accidents with other vehicles or objects. Comprehensive covers damage from theft, vandalism, or natural disasters. While not mandatory, they help avoid expensive repairs or replacement costs.

| Coverage Type | What It Covers | Importance |

|---|---|---|

| Liability | Damages to other vehicles and people | Legally required, protects your finances |

| Collision | Damage to your vehicle from collisions | Helps avoid costly repairs |

| Comprehensive | Non-collision related incidents like theft or natural disasters | Provides broad protection for your vehicle |

Knowing about the different auto insurance coverage options helps you make smart choices. It ensures your vehicle and finances are well-protected.

Factors that Influence Auto Insurance Rates

Auto insurance rates can change a lot based on several key factors. Knowing these can help you save money. Let’s look at two big ones: your driving record and your vehicle’s make and model.

Driving Record

Your driving history is very important to insurance companies. A clean record means lower premiums. But, a record with accidents or tickets can raise your rates a lot.

Insurance companies see these incidents as signs of future claims. They adjust prices to manage their risk.

Vehicle Make and Model

The type of car you drive also affects your insurance costs. Cars that cost more to fix or are at higher theft risk have higher rates. Things like safety features and value also matter.

Driving a luxury or high-performance car means higher premiums. But, standard cars are often cheaper to insure.

Understanding these factors can help you save on insurance. A clean driving record and choosing the right car are key steps. They can help you get the best insurance deal.

“Knowing the factors that shape your auto insurance rates can empower you to make informed decisions and potentially lower your costs.”

How to Get Auto Insurance Quotes

Getting auto insurance quotes is key to finding the right coverage for your car. By comparing quotes from different providers, you can see rates, options, and find the best policy for your budget. Here’s how to get auto insurance quotes:

- Gather the necessary information: Before you start, make sure you have all the relevant details about your vehicle, driving history, and personal information on hand. This includes your car’s make, model, year, and VIN number, as well as your age, driving record, and any previous claims or accidents.

- Identify your coverage needs: Determine the type and level of auto insurance coverage you require, whether it’s liability, collision, comprehensive, or additional options like roadside assistance or rental car reimbursement.

- Shop around: Visit the websites of multiple auto insurance providers or use online quote comparison tools to get personalized auto insurance quotes. This allows you to compare rates and coverage options side-by-side.

- Compare and analyze: Review the quotes you’ve received, paying close attention to the coverage limits, deductibles, and any discounts or bundling opportunities. This will help you identify the most cost-effective and comprehensive policy for your needs.

- Make an informed decision: Once you’ve compared the auto insurance quotes, select the policy that provides the best balance of coverage and value. Remember to consider factors beyond just the price, such as the insurance provider’s financial stability, customer service, and claims handling.

By following these steps, you can ensure you obtain the auto insurance quotes that will help you find the right coverage for your vehicle and your budget.

“Shopping around for auto insurance quotes can save you hundreds, if not thousands, of dollars on your annual premiums.”

Comparing Auto Insurance Companies

When looking for auto insurance, it’s key to compare more than just rates and coverage. You should also check the company’s reputation and financial health. This guide will help you understand customer service and financial strength, so you can choose wisely.

Customer Service Ratings

Good customer service is crucial when dealing with insurance claims or policy management. Look for companies with high ratings from J.D. Power, the NAIC, and online reviews. These ratings show how well the company responds to your needs and treats its customers.

Financial Strength

Choosing a financially stable insurance company is vital. Check the ratings from A.M. Best, Moody’s, and Standard & Poor’s. These ratings show if the company can pay claims on time. A strong financial rating means your vehicle is well-protected.

FAQ

What types of auto insurance coverage are available?

Auto insurance comes in several types. Liability coverage pays for damages to others. Collision and comprehensive coverage protect your vehicle.

What factors influence auto insurance rates?

Several factors affect auto insurance rates. These include your driving record and the vehicle’s make and model. Your age, credit history, and location also play a role.

How can I get the best auto insurance quotes?

To find the best quotes, shop around and compare. Have details about your vehicle, driving history, and coverage needs ready. This helps you get accurate quotes.

How can I compare different auto insurance companies?

Compare companies by looking at customer service, financial strength, and coverage options. Choose a reputable provider for reliable coverage and claims handling.

What can I do to lower my auto insurance premiums?

Lower premiums by maintaining a good driving record and taking discounts. Increasing deductibles and bundling policies can also help.